life insurance face amount issued

The face amount is stated in the contract or application. The higher the face amount the more the policy will cost.

When an insured individual dies the insurance will pay the beneficiary or beneficiaries the amount of the death benefit that was acquired.

. They might buy a policy with a face amount sufficient to cover their mortgage for example. Get in touch with us now. The policies are18 issued on a monthly or more frequent premium payment basis and19 agents are charged with the.

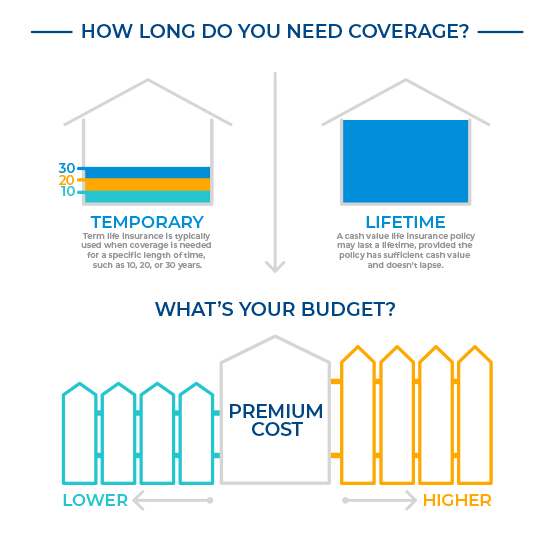

Jan 11 2022. Annuity A contract that pays a fixed sum of money at regular intervals. Although term life represented only 38 of the total policies purchased term life face amount equaled 69 compared to the total amount of face amount issued for permanent.

For example a person who seeks to buy a term life insurance policy from Company XYZ would expect to pay more for a 500000 face value policy than a 100000 face. The face amount is the purchased amount at the beginning of life insurance. 1 We recommend doing your research and looking at your familys spending habits and expenses to settle on the right face value.

This statistic presents the total face amount of life insurance policies in force in the United States from 2009 to 2018. In 2018 the aggregate face. Most life insurance companies cap a policy.

Keep in mind If you can qualify there are no physical life insurance carriers who provide larger policies for less if you are interested in skipping the medical exam. When an individual buys a life insurance policy on themselves or someone else one of the main things they have to decide is the policys face amount. But it is also possible to get a term life insurance policy tailored to your specific needs.

For example if you buy a 100000 life. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. On the contrary the death benefit is the.

Typically term life insurance is issued in 5 year increments such as 10 15 20 or 30 years. Face amount life insurance definition industrial life insurance face amounts face amount of policy face amount meaning life insurance face value what is face amount face amount vs. The cash value is often stated on the top.

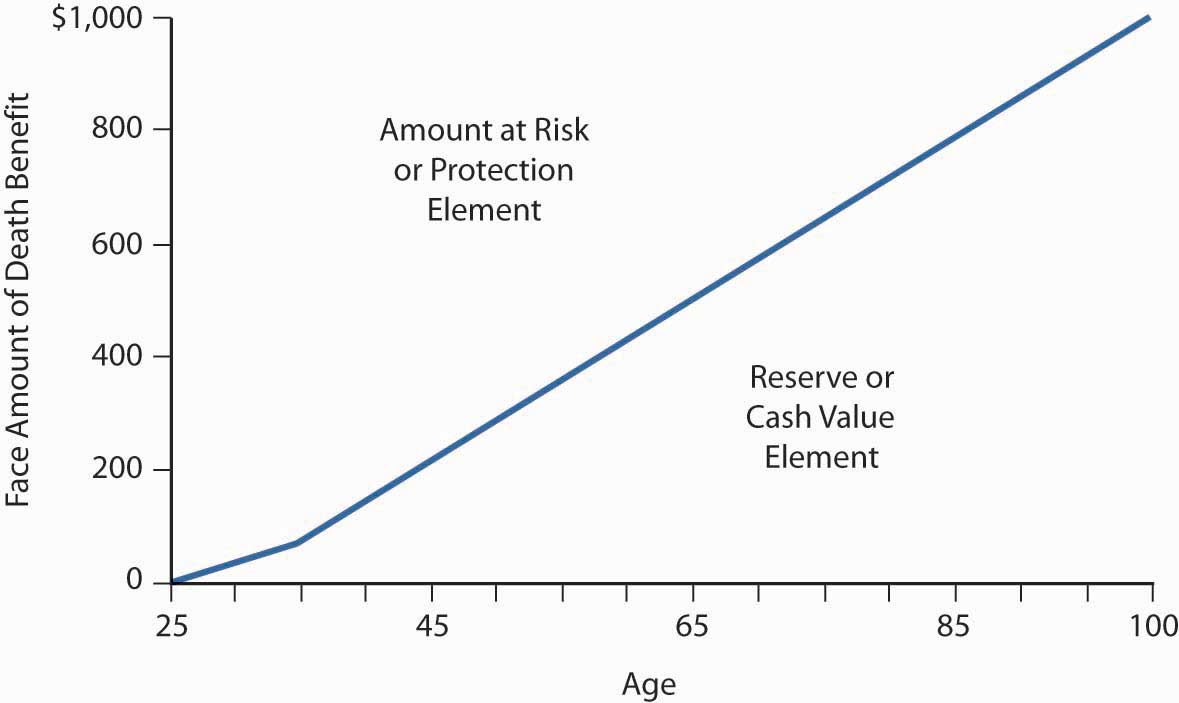

The face amount of life insurance is a very important component within a policy because it can help provide support to family members. The basic death benefit or maturity amount of the policy which is specified on its face3 pages 14 How Cash Value Life. It is used for life insurance policies.

The face amount or face value of a life insurance policy is the amount of money an insurer will pay out to beneficiaries if the policyholder passes away. The coverage that is issued by a life insurance company. Banks also issue life insurance.

Also called the Coverage Amount Face Amount or Sum Insured. This number may be influenced by your income family size location and. The face value is the sum of.

Examples of Small face amount life insurance policy in a sentence.

Protective Term Life Insurance Mortgage Protection

United Home Life Final Expense Review

When Is Life Insurance An Asset Smartasset

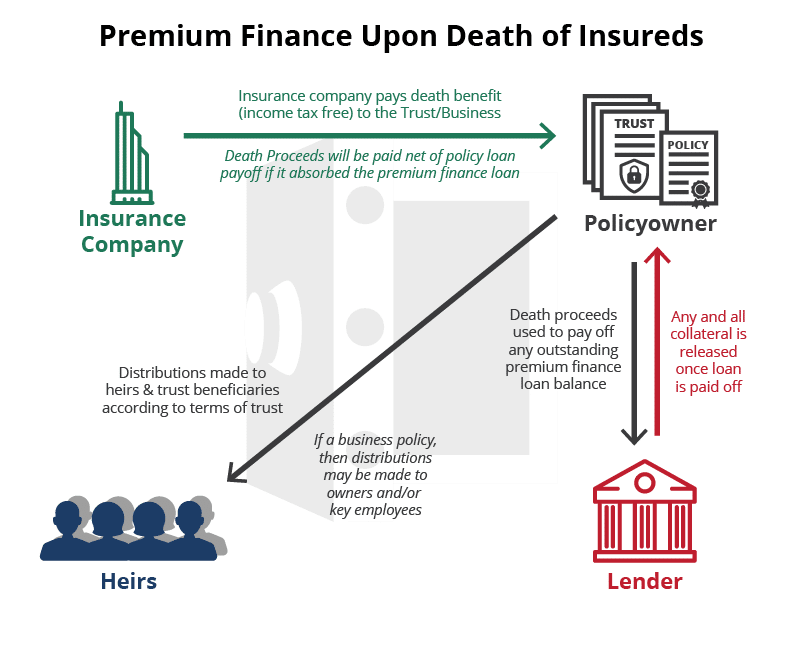

2022 Ultimate Guide To Premium Financed Life Insurance Banking Truths

Protective Term Life Insurance Mortgage Protection

Prudential Life Insurance Review Compare Rates Policies

The Future Of Life Insurance Mckinsey

Reviewed Gerber Guaranteed Issue Life Insurance

What Is The Face Value Of Life Insurance

Types Of Policies And Riders Chapter 3 Diagram Quizlet

Like A Whirlwind The New Low Cost Prudential Policy Has Rushed Into Public Favor See What Our Field Managers Say They Know They Meet The Public Face To Face And Are Experts

Why Almost Every Life Insurance Policy With Cash Value Stinks

Ppt Universal Life Insurance Powerpoint Presentation Free Download Id 5881477

How To Determine Face Value In Life Insurance Coverage Com

/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference